However, knowing the correct what, when, and how of sending an invoice is ultimately up to you.įortunately, learning the different types of invoices you can send to your clients (and when it’s right to use each) is incredibly simple.

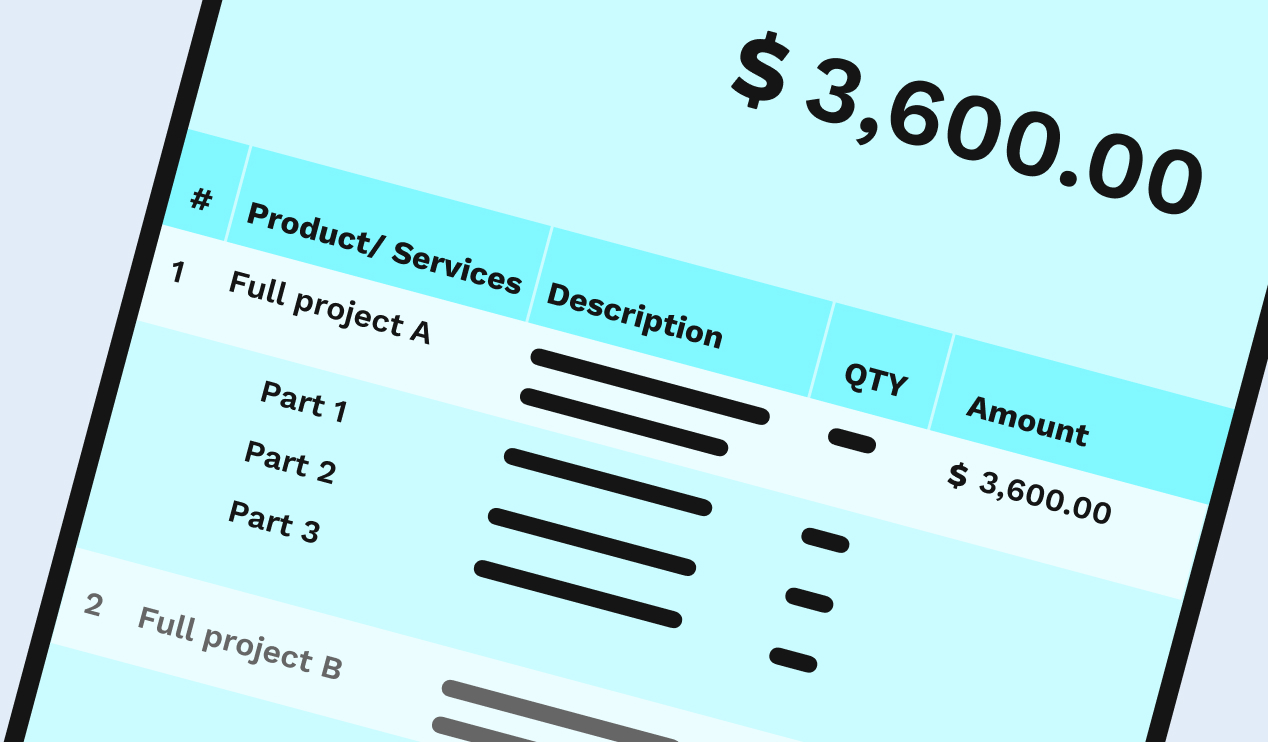

In the modern age, services like invoicely make creating, sending, and filing away invoices a breeze. But there’s not just one type of invoice used in the business world, and knowing which types of invoices to use can be crucial to getting paid. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.While traditional employees eagerly await their paychecks, freelancers and small business owners rely on something much different for their income: the humble invoice. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. We provide third-party links as a convenience and for informational purposes only. Readers should verify statements before relying on them.

DEFINE INVOICE COST FREE

does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Accordingly, the information provided should not be relied upon as a substitute for independent research. does not have any responsibility for updating or revising any information presented herein. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Applicable laws may vary by state or locality. Additional information and exceptions may apply. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. Let’s take a closer look at some of the benefits and drawbacks to consider before moving forward with invoice factoring. Like any financing decision, there are several pros and cons associated with invoice factoring.

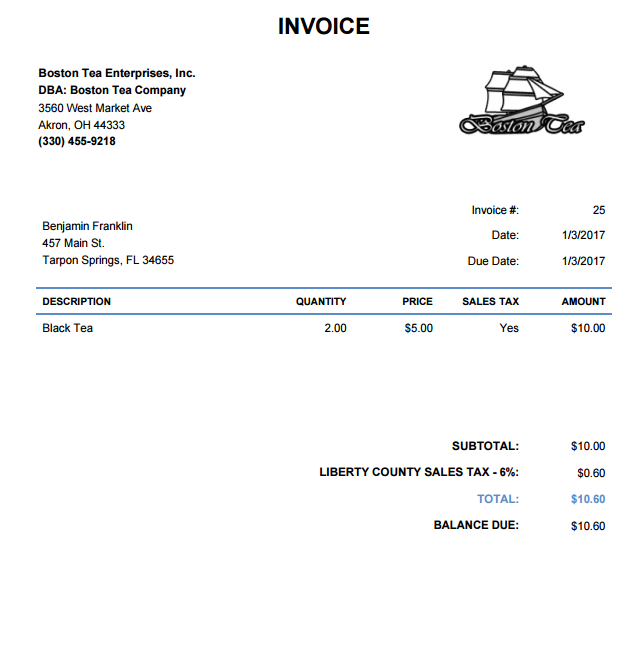

Rather than reaching out to a traditional bank for a loan, you decide to take a look at your accounts receivable.Īfter some investigation, you find that you have $25,000 in outstanding invoices.

Let’s say your small business needs $20,000 to replace some necessary equipment, but you don’t have the working capital to do so. Invoice factoring leverages a small business’s outstanding invoices by turning them into cash.

0 kommentar(er)

0 kommentar(er)